A term insurance policy is one of the best additions to any portfolio, ensuring financial security for family members in the event of the policyholder’s demise within the policy tenure. This is one of the many term insurance benefits that draw more people toward these plans. At the same time, the medical history of the policyholder and other family members is crucial while purchasing term insurance. There are several scenarios where medical tests may be necessary since they may directly impact your premiums. Here’s learning more about the various medical tests that may be necessary while buying a term insurance plan.

Why are medical tests necessary?

When you buy a term insurance policy, there are a few criteria that you should fulfil. First, you will have to fill up the form and provide documents that affirm your identity. You may have to take a medical test as well. This helps the insurer assess your medical condition and risk levels before setting the premium for your desired coverage amount.

As a result, applicants with good health conditions will benefit from lower premiums. Those with critical illnesses or medical issues may likewise witness a rise in their premium amounts. A medical test enables better decision-making on the part of the insurer. It also ensures that claims are not rejected in the future since non-disclosure of medical conditions leads to issues later on. If your medical tests come out fine, you may also have a chance to qualify for a higher sum assured amount. Now that you have an idea about the importance of these tests, here’s looking at the multiple test types you may need to go through.

What are the necessary medical tests for term insurance?

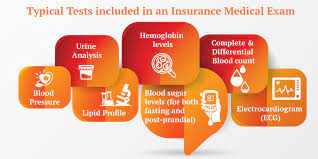

There are quite a few tests that policyholders may have to take before buying a term insurance policy. Some of them include the following:

- BMI Tests- These calculate the weight and height of the policyholder and then work out the BMI (body mass index). It is not a technical measurement of any health condition but only a foundation for other follow-up examinations.

- Urine Tests- Urinalysis may be necessary for determining any underlying health conditions or bodily troubles

- Blood Test- Many insurers insist on blood tests to determine an individual’s medical condition across several parameters. Further testing may be necessary in case of any adverse symptoms.

- CBC- Complete Blood Count (CBC) counts the total blood cells in the body. Any side effects are easy to determine with this procedure. It may also help in uncovering any hidden or undiagnosed troubles.

- Blood Sugar Test- Insurance medical tests usually take fasting blood sugar into account. The test measures the glucose or sugar amount in the blood. It helps in the diagnosis of diabetes.

- Kidney Function Test- This helps determine the functioning and health of the kidney. A urine or blood sample may be necessary for the procedure.

- Liver Function Test- This is a crucial test that determines the liver condition and how it functions. It contains several steps for analyzing blood protein content and enzyme levels alike. This test also helps in the diagnosis of medical issues like hepatitis.

- Lipid Profile Test- These tests help identify cholesterol-related and other lifestyle diseases in the body. Knowing about any cholesterol or fat-related abnormalities is essential for forecasting a person’s health in the future.

- Echocardiography- It is a test that can generate images of the heart while tracking its functioning and predicting risks. These tests may encompass stress echocardiography, ECGs, and 3D echocardiography.

- Chest X-Rays- These use radiation beams to gain more knowledge of the functioning of one’s bones, heart, and lungs. It is a test that insurers prefer to get a better picture of any minor ailment that impacts the person’s airways or blood vessels.

- HIV Test- It helps in ascertaining whether an individual is HIV positive or not

- Ultrasonography- This helps diagnose severe conditions like cancer and others

- Comprehensive Trail-Making Test- It measures visual attention and delves deeper into psychoanalysis

- Treadmill Test- It is a voluntary examination where people get information about their cardiovascular rates, pressure rates, blood flow, and breathing capacity

Conclusion

You may need to undergo many such tests based on your insurance company’s policies. Yet, not all tests are compulsory for getting term insurance. Some companies may have a few tests that they insist on, while testing may also vary across applicants. Hence, check these clauses in your policy document and reach out to your insurer for more details.

Apart from that, if you are interested to know about Home Sleep Apnea Tests then visit our Business category.