Crypto options analytics is a powerful, if not essential, tool for traders looking to maximize their profits in the cryptocurrency market. By leveraging analytics to look at options data, traders can gain valuable insights into market behavior and make more informed trading decisions. It’s their edge.

The goal of this guide is to provide readers with a detailed overview of the different trading strategies that can be used with crypto options analytics. We will cover the basics of options trading and how options pricing models work, as well as the different strategies that traders can use to profit from the market.

Whether you are a seasoned trader or just getting started in the world of cryptocurrency, understanding how to use options analytics can give you an edge in the market and help you achieve your trading goals.

So let’s dive in and explore the exciting world of crypto options analytics and trading strategies.

Understanding Crypto Options Analytics

In order to effectively use crypto options analytics, it’s important to first understand the basics of options trading and how options pricing models work.

Options are contracts that give traders the right (but not the obligation) to buy or sell an asset at a predetermined price (known as the strike price) on or before a specific date (known as the expiration date). Options can be used to hedge against risk or to speculate on the direction of the market.

Options pricing models use a variety of factors to determine the value of an option, including the current price of the underlying asset, the strike price, the time remaining until expiration, and the implied volatility of the asset.

Implied volatility is a measure of the expected volatility of the underlying asset over the life of the option contract. Higher levels of implied volatility indicate that the market expects the asset to experience more price movement, while lower levels indicate less expected movement.

By analyzing options data and implied volatility levels, traders can gain valuable insights into market sentiment and make more informed trading decisions. In the next section, we’ll explore the different trading strategies that traders can use with crypto options analytics.

Key Analytics to be on the Lookout for

Implied volatility

● A measure of the market’s expectations for the future volatility of an asset’s price, derived from the price of its options.

● Implied volatility can help traders gauge the level of risk associated with an asset and determine the potential profitability of a trade.

Implied volatility vs. realised volatility

● Implied volatility is based on market expectations and is forward-looking, while realised volatility is based on historical data and is backward-looking.

● Implied volatility is often higher than realised volatility, as it includes the market’s uncertainty about future events.

Implied Volatility-Realised Volatility

● The difference between implied volatility and realised volatility is often used by traders to identify potential trading opportunities.

● If implied volatility is significantly higher than realised volatility, it may suggest that options prices are overpriced and present a potential opportunity for selling options.

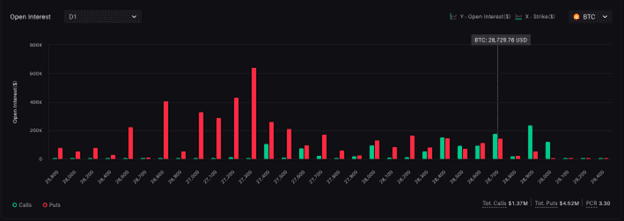

Open Interest

● The total number of outstanding options contracts that have not yet been exercised closed out or expired.

● Open interest is an important metric for options traders, as it indicates the level of activity and interest in a particular option contract.

Open Interest Change

● The change in the number of outstanding options contracts from one day to the next.

● Open interest change can help traders identify shifts in market sentiment and potential changes in the underlying asset’s price.

Cumulative Open Interest

● The total open interest of an options contract over a period of time, often used to identify trends and potential trading opportunities.

● Cumulative open interest can help traders gauge the level of interest and activity in a particular options contract over time.

Where do I Find These Analytics?

All these metrics are easily identifiable through a quick Google search – just type in the ticker for the option that you’re interested in analysing followed by which analytics you’re looking for.

Common examples would be to Google “BTC Call Open Interest” or “ETH Put IV vs RV”.

Trading Strategies Using Crypto Options Analytics

There are a variety of trading strategies that traders can use with crypto options analytics to profit from the market. Here are some of the most common ones:

● Delta Hedging – This strategy involves hedging against price movements in the underlying asset by buying or selling options contracts. Delta is a measure of the rate of change in the price of an option relative to changes in the price of the underlying asset.

● Gamma Scalping – This strategy involves buying and selling options contracts in response to changes in the price of the underlying asset. Gamma is a measure of the rate of change in delta relative to changes in the price of the underlying asset.

● Long Straddle – This strategy involves buying both a call option and a put option with the same strike price and expiration date. It profits if the underlying asset’s price moves significantly in either direction.

● Short Straddle – This strategy involves selling both a call option and a put option with the same strike price and expiration date. It profits if the underlying asset’s price remains relatively stable.

● Bull Call Spread – This strategy involves buying a call option with a lower strike price and selling a call option with a higher strike price. It profits if the underlying asset’s price increases.

● Bear Put Spread – This strategy involves buying a put option with a higher strike price and selling a put option with a lower strike price. It profits if the underlying asset’s price decreases.

● Iron Condor – This strategy involves combining a bull call spread and a bear put spread. It profits if the underlying asset’s price remains within a certain range.

● Butterfly Spread – This strategy involves buying both a call option and a put option with the same strike price and then selling two options with a lower strike price and two options with a higher strike price. It profits if the underlying asset’s price remains close to the strike price.

● Covered Call – This strategy involves buying an underlying asset and then selling a call option on that asset. It profits if the underlying asset’s price remains relatively stable.

● Protective Put – This strategy involves buying an underlying asset and then buying a put option on that asset. It profits if the underlying asset’s price decreases.

Final Word

Crypto options analytics can be a powerful tool for traders looking to take advantage of opportunities and manage risk in the volatile world of cryptocurrency trading. By understanding the basics of options trading and the Greeks, using multiple indicators, conducting thorough research, practicing with paper trading, and managing risk carefully, traders can increase their chances of success.

However, it’s important to remember that options trading involves a significant amount of risk, and traders should always conduct their own research and analysis before making any trades. With these tips in mind, traders can use crypto options analytics effectively to navigate the fast-paced and ever-changing world of cryptocurrency trading.

Apart from that, if you are interested to know about Google vs Facebook Advertising then visit our Digital Marketing category.