Startup financing is the amount that a business owner needs to start a new venture. It helps fund the initial costs such as buying necessary equipment, renting out an office space for the new company, and much more. Startup financing is a critical step in starting a new business.

When you work with a traditional lender, startup financing becomes a challenging task. In this post, we shall discuss the complete guide for startup financing.

Is Startup Financing required?

Startup financing helps in executing your business and managing those costs until you start generating revenue. You would need a budget and a proper business plan to kick off your startup business. Many people work hard to build a startup company, so they can be able to bring their products to the market.

Some lenders may be reluctant to work with startup companies because they do not have a business history to demonstrate their financial ability to repay their loans.

If you have been in business for less than a year, or if you need capital to start a business, you will need to borrow money based on your personal finances. However, funding startups and small businesses is a difficult and time-consuming process, especially for low-credit companies. There is no minimum credit rating you need to get a business loan, but traditional lenders have a range or standard that they usually think is acceptable.

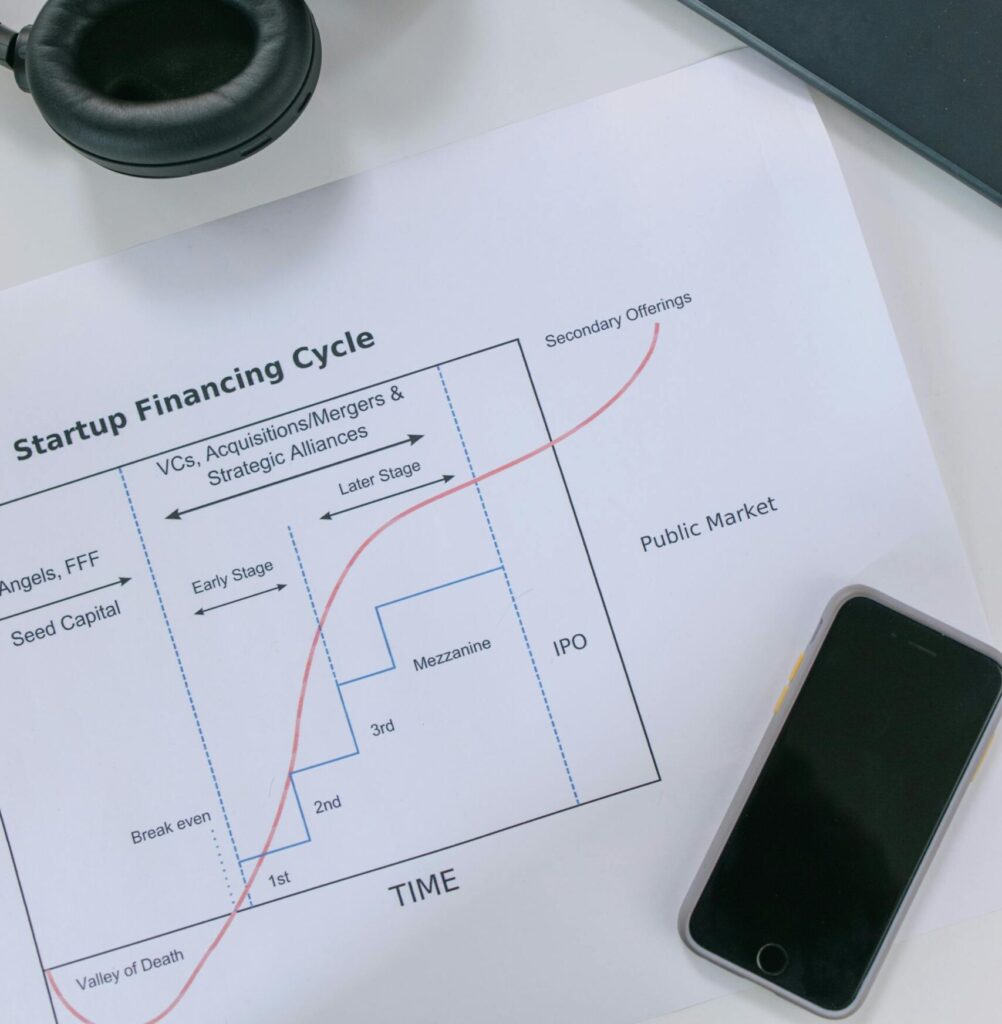

Types of Startup Financing

When you know how much money you will need for your startup and your business goals, it will be easier to decide what kind of funding you will need.

The types of startup financing are:

- Small business loan

- Venture capitalists

- Crowdfunding

- Owner’s Funds

Small Business Loan

When you are looking for a free funding startup, then you can choose loans for new businesses. In small business loans, you do not have to repay subsidies or pay interest like you would with a normal loan.

Small business loans help businesses make bulk purchases and cover their business costs. Loans are usually issued as a lump sum that you can use to make certain purchases or to manage your cash flow, and then pay off with interest.

However, there are other types of small business loans, such as lines of credit, merchant cash advances, and account loans, that you can use to get faster access to cash depending on your needs.

Even if you have bad credit, you can get a small business loan. This is because your credit score is not as important as your company’s overall financial health. When your small business loans are used properly, then your company’s growth will increase. It is one of the easiest ways to get funds without waiting for your business to get enough profit to raise its own expansion.

Read more: How to Choose the Right Business Loan for Your Startup?

Venture Capitalists

Venture Capitalists provide capital to companies in return for equity stakes. This could fund startups or help small businesses that want to expand but do not have access to the stock market.

Venture Capitalists are professional investors who invest in startup companies and provide proper guidelines to increase their professional network for their new company. If you already have an angel investor, and you are about to launch your first version of your product, then it is time to think about getting help from venture capitalists. A venture capital firm is an official and trusted financial intermediary that allows you to invest in a group of people or organizations.

Crowdfunding

Startup businesses will often solicit funds from various backers who fund their startups without asking for a share or interest. This method is called crowdfunding and is a way of raising money for low-risk businesses. It is also the best platform to promote your idea.

Crowdfunding is an effective way to raise capital. The main advantage for entrepreneurs is that it allows you to build a community of supporters who care about your business and are committed to your idea.

This can be a particularly effective way to raise money if you have a specific target market and if you know the best platform to promote your idea. Crowdfunding is used by both small businesses and startups.

Owner’s Funds

The total amount invested by an enterprise’s owner and the accumulated profits that they have reinvested in the business are referred to as the owner’s funds. This method of raising capital uses the personal funds of an entrepreneur or business owner to create a startup. Owners may use the savings they have earned to pay for their expenses. They can even get a new mortgage on their personal investment to raise the cash they need.

How to get Startup Funds?

If you get to know about the amount required for your startup and your business goals, then it is easier for you to choose what type of funding you need.

- Identify the funding amount required

- Have a business plan

- Maintain all your records

- Choose the right type of funding for you

- Return the borrowed amount

Identify the Funding Amount Required

If you are looking to fund a larger one-time purchase, a business credit card might be the right choice. Investors may be more sensible if they are looking for substantial funds. Estimate the amount you need before applying or contacting the network.

Have a Business Plan

Make a proper business plan before you start with any new business. The business plan is required by many lenders and potential investors. The business plan helps you in describing your business model, funding requirements, and monetization plan.

Secure All of Your Records

When you want to get your small business loans approved, then you should have your records maintained in a proper manner. The records include business tax papers, personal tax papers, bank statements, business financial statements, and other legal documents that support your business.

Choose the Right Funding for You

Do your research in a proper manner so that you will get to know where to get funds for your startup business. When you make sure where to get your funds from, then you can easily proceed with your business plan.

Return the Borrowed Amount

When you are planning to get some funding for your new startup then make sure to return the borrowed amount. You must use the ROI calculator or the investment calculator to estimate your payments and maintain them within your budget.

Conclusion

In this article, we have covered how a startup company can survive and grow through raising money, keeping your organization slim, and focusing on maximizing opportunities.

A strong financial leader is one of the key partners who can take responsibility for entrepreneurs, so they can focus on doing their best. Financing is required to fully capitalize on current and future market opportunities.

Apart from this, if you are interested to know about Laptops for Music Production then visit our Business category.