Last Updated on November 4, 2023 by Hina Rubab

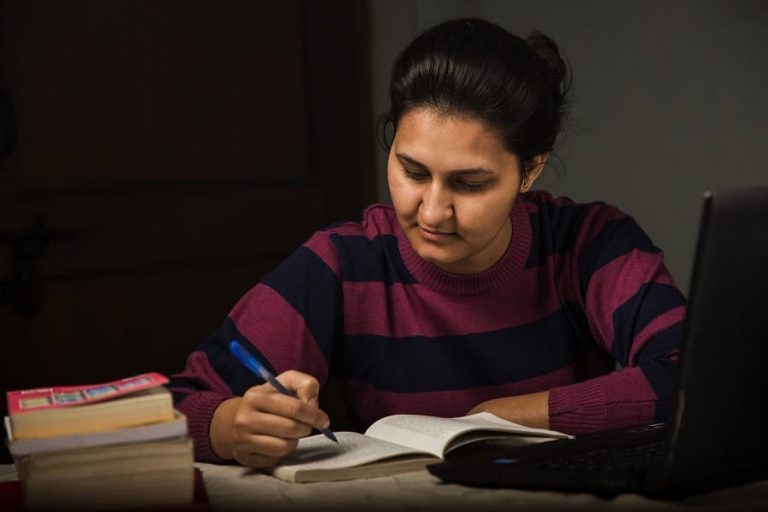

The job of an IBPS Probationary Officer is considered to be quite lucrative. If you manage to get recruited as an IBPS PO, you will be handling the majority of the work of the bank. So, if you are looking to work in a high-ranking post and get the right package, IBPS offers a good career scope. This is a government-based job whose salary is under the guidelines of the banking sector. Just like most government banking positions and jobs, you will have to clear an entrance test organized by the IBPS to get a job as an IBPS PO. The exam dates are announced months before the exam so that students like you can have enough time to prepare for the exam. Read on to learn why IBPS is a sought-after career.

The probationary officer is an entry-level job for someone who wants to start a career in the banking sector. There are two phases of the selection process. The first phase is the written examination followed by the interview as the second phase. Once you have passed both the phases and gotten selected, you will be able to start working as an assistant manager. The bank organizations conduct several exams regularly to promote their employees. However, most of the time, promotions are done on the basis of seniority.

Career path of IBPS PO

Both college freshers and graduates can get the job of the PO or any other in the banking sector. However, if you want to get the job, you will have to take the entrance exam and clear the selection processes. Every year, the Banking Service Recruitment Board conducts the test and takes care of the entire selection process.

If you are selected, you will join the bank as a probationer and work for the first two years and gain enough experience. During this time, you will be performing different clerical roles which will also help you get a raise in position and salary. Once you become a senior, you will be given multiple responsibilities and will work in different departments.

The normal job of a probationary officer is handling administration, communicating with the customers, and resolving conflicts between the customers and the officials. Once you have finished your two years of the probationary period as the PO and got familiar with all the departments, you will be promoted to the assistant manager who has similar responsibilities as the PO. The next position that you can aim for is that of the Branch Manager who handles the day-to-day responsibilities of the branch and works as the department’s head. Next comes the position of the Chief Manager who takes care of the main branch of the bank. So, your career path will begin from PO and reach to General Manager which is accompanied by a very handsome package. However, to reach this highest position, you will have to work for more than 14 years. Some public sector banks have tie-ups with overseas banks so you might get an opportunity to work there.

As an IBPS PO, you will have an excellent career path ahead of you. Your career growth will be determined by your merit. The PO is a Scale I Officer who normally becomes a Scale II Officer (Manager) in 3 to 4 years. The promotion will be given through a written exam and an interview. There can be a slight variation from bank to bank in terms of time and process of the promotion. However, regardless of what bank you are working for, you will have fast-track promotion opportunities. Since you will be a generalist as a PO, you will have the opportunity to work in different departments like operations, foreign exchange, credit, risk, audit, investment banking, etc. Banks conduct internal exams for posting in foreign offices and investment banking.

The career growth for you, as a PO, will be fast. Depending on the vacancies in the bank, you can expect a promotion every 3 to 5 years. The promotion grades include Scale II (Manager), Scale III (Senior Manager), Scale IV (Chief Manager), Scale V (AGM), Scale VI (DGM), and Scale VII (GM). After that comes the position of CMD (Chairman and Managing Director) and Executive Director which are appointed by the government. Almost all CMDs and EDs of banks began their career as PO. Some of them had the opportunity to work as the Deputy Governor (DG) in the Reserve Bank of India. So, if you want to make a career in the banking industry, PO is the best place to start.

Responsibilities

As an IBPS PO, you will have some important responsibilities which include different operations like mortgage, issuing cheques, loans, etc. Here are some other job roles:

- Getting new business – Apart from dealing with the daily customers, you will also be required to get new business to your bank. For this, you can offer promotion of services like opening a new account, insurance policies, mutual funds, fixed deposits, etc. If you are working as a handling cash officer, you will be responsible for cash disbursal, cash transactions, loading the ATMs, etc.

- Official communication – As a PO, you will have to track the latest news about the banking sector and ensure that your customers and banking officials are updated.

Your working conditions as an IBPS PO will depend on the type of bank you are working for. You will have common working hours like others, but they might increase during the end of the financial year. As an IBPS PO, you will also be able to enjoy incentives and benefits like medical allowances, maternity leaves, pensions, etc.

IBPS PO is a promising job profile. And, if you are working for a government bank and you have good work ethics, you can expect a good raise in the future. However, in order to get the job, you have to first pass the entrance test. And, for every promotion, you will have to go through another selection process. Click here for more info on the IBPS PO exam.

Apart from that if you want to know about Strong Company Culture in a Virtual Environment then please visit our world category.